INTERNATIONAL FINANCE BANK

COMMUNITY REINVESTMENT ACT (CRA)

PUBLIC FILE 2025

For additional information, please contact our CRA Officer or Compliance Department at: (305) 648-8895

PROPERTY OF INTERNATIONAL FINANCE BANK — DO NOT REMOVE

COMMUNITY REINVESTMENT ACT STATEMENT

International Finance Bank, its directors, officers and staff are fully committed to serving our community's needs for banking services.

The Bank's goal is to provide the largest possible of our service area's business and residents access to its wide variety of banking products and services.

We are also committed to playing a role in the betterment of our community (also referred to as its service area) by investing its efforts, assets, and resources to the best of our ability.

This commitment is demonstrated in the form of concerted efforts to improve the overall economic status of the community we serve.

Since its inception in 1983, International Finance Bank has successfully offered its financial services and continues its outreach to its community and customer base.

International Finance Bank's service area currently includes the entirety of Miami-Dade County and the greater New York, NY.

INTERNATIONAL FINANCE BANK

Products and Retail Services

Personal Banking

| Depository Products | Loans & Credit Plans |

|---|---|

| Checking Account | Residential Mortgage / Refinance |

| Senior Citizen Checking Account | Professional's Program |

| Money Market Account | Home Equity Lines of Credit |

| Interest Checking — NOW Account | Construction Permanent Financing |

| Certificate of Deposit | Cash Secured Loan |

| Saving Account / ICS/CDARS |

Business Banking

| Depository Accounts | Loans & Credit Plans |

|---|---|

| Business Checking Account | Business Loans |

| Business Money Market Account | Leasehold & Capital Improvement |

| Certificate of Deposit / IOTA Account | Asset Based Loans |

| ICS/CDARS | Commercial Real Estate |

| SBA 504 Loans and SBA 7(a) Loans | |

| Letters of Credit |

Conveniences

| Service | Description |

|---|---|

| Remote Deposit | Online Banking |

| ACH Origination | Mobile Banking |

| Bill Payment Services | Mobile Deposit |

| Cashier's Checks | Zelle |

| Debit Card | Wire Transfer |

| Acceptance of Direct Deposits | Safe Deposit Box |

| Drive-through location | Bank by Mail |

| Loan Production Office | Aventura Loan Production Office 2980 NE 207 Street, #516, Aventura, FL 33180 MSA 33124 Census Tract 0001.34 Income Level Upper |

INTERNATIONAL FINANCE BANK

Branch Locations & Hours

Douglas Banking Center: 777 SW 37th Avenue, Miami, Florida 33135.

Hours: Mon to Thurs: 9am to 4:30pm (5pm on Fri).

Drive Through: Mon to Fri (8am to 5pm).

CRA Info: MSA: 33124 | Census Tract: 0055.03 | Income Level: Middle.

Note: Night Deposit Available.

New York Banking Center: 623 Fifth Avenue, New York, New York 10022.

Hours: Mon to Fri: 9am to 4:30pm (5pm on Fri).

CRA Info: MSA: 35614 | Census Tract: 0102.00 | Income Level: Unknown.

NIGHT DEPOSIT AVAILABLE AT DOUGLAS BANKING CENTER

ATM NOT AVAILABLE (NO FEE ATM WITHDRAWALS AT CITIBANK BRANCHES IN THE US - UP TO FIVE ATM TRANSACTION FEE REIMBURSEMENTS AT OTHER ATMS PER MONTH).

Branches Opened or Closed

2023 — NONE

2024 — NONE

2025 — NONE

Loan to Deposit Ratio

| Date | Ratio |

|---|---|

| 12/31/2024 | 95.86% |

| 09/30/2024 | 94.73% |

| 06/30/2024 | 94.77% |

| 03/31/2024 | 91.53% |

| 12/31/2023 | 92.73% |

| 09/30/2023 | 95.63% |

| 06/30/2023 | 97.02% |

| 03/31/2023 | 98.07% |

IFB has not received any comments from the public.

CRA Assessment Area Maps

FFIEC Geocoding System — 2020 Census

Miami, FL

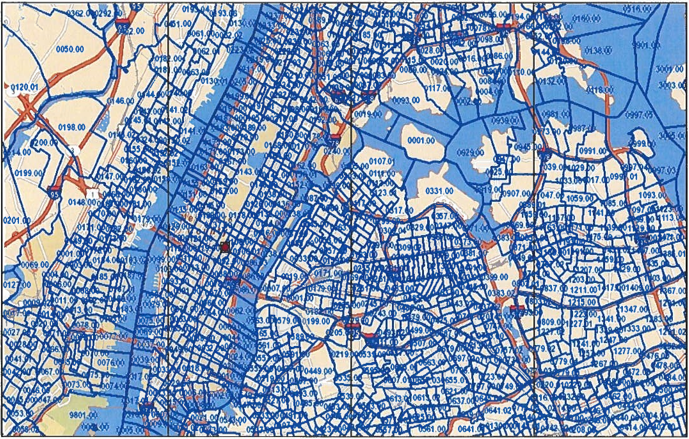

FFIEC Geocoding System — 2020 Census

New York, NY

HOME MORTGAGE DISCLOSURE ACT NOTICE

The HMDA data about our residential mortgage lending are available online for review. The data show geographic distribution of loans and applications; ethnicity, race, sex, age, and income of applicants and borrowers; and information about loan approvals and denials. HMDA data for many other financial institutions are also available online.

For more information, visit the Consumer Financial Protection Bureau's website (www.consumerfinance.gov/hmda).

International Finance Bank

CRA Performance Evaluation

Attached

PUBLIC DISCLOSURE

September 30, 2021

COMMUNITY REINVESTMENT ACT PERFORMANCE EVALUATION

International Finance Bank

Certificate Number: 24823

777 SW 37th Avenue, Suite 700

Miami, Florida 33135

Federal Deposit Insurance Corporation

Division of Depositor and Consumer Protection

Atlanta Regional Office

10 10th Street NE, Suite 800

Atlanta, Georgia 30309-3849

This document is an evaluation of this institution's record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, nor should it bc construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution.

TABLE OF CONTENTS

| INSTITUTION RATING | 1 |

| DESCRIPTION OF INSTITUTION | 2 |

| DESCRIPTION OF ASSESSMENT AREAS | 3 |

| SCOPE OF EVALUATION | 3 |

| CONCLUSIONS ON PERFORMANCE CRITERIA | 5 |

| DISCRIMINATORY OR OTHER ILLEGAL CREDIT PRACTICES REVIEW | 9 |

| STATE OF FLORIDA | 10 |

| DESCRIPTION OF INSTITUTION’S OPERATIONS IN FLORIDA | 10 |

| SCOPE OF EVALUATION - FLORIDA | 13 |

| CONCLUSIONS ON PERFORMANCE CRITERIA IN FLORIDA | 13 |

| STATE OF NEW YORK | 19 |

| DESCRIPTION OF INSTITUTION'S OPERATIONS IN NEW YORK | 19 |

| SCOPE OF EVALUATION — NEW YORK | 22 |

| CONCLUSIONS ON PERFORMANCE CRITERIA IN NEW YORK | 22 |

| APPENDICES | 24 |

| INTERMEDIATE SMALL BANK PERFORMANCE CRITERIA | 24 |

| SUMMARY OF RATINGS FOR RATED AREAS | 25 |

| GLOSSARY | 26 |

Institution Rating

INSTITUTION'S CRA RATING: This institution is rated Satisfactory.

- The Lending Test is rated Satisfactory.

- The Community Development Test is rated Satisfactory.

The loan-to-deposit ratio is reasonable given the institution's size, financial condition, and assessment area credit needs. A majority of the institution's loans were originated within the assessment areas.

Description of Institution

International Finance Bank (IFB) is a state-chartered commercial bank headquartered in Miami, Florida. IFB currently operates two full-service offices, including its main office in Miami, Florida and an office in New York City, New York. IFB's assets totaled $926.9 million, as of June 30, 2021.

Loan Portfolio Distribution as of 6/30/2021| Loan Category | $(000s) | % |

|---|---|---|

| Construction, Land Development | 29,175 | 4.1 |

| Secured by Farmland | 0 | 0.0 |

| Secured by 1-4 Family Residential | 158,782 | 22.2 |

| Secured by Multifamily (5+) | 57,947 | 8.1 |

| Secured by Nonfarm Nonresidential | 197,585 | 27.7 |

| Total Real Estate Loans | 443,489 | 62.1 |

| Commercial and Industrial | 241,385 | 34.4 |

| Consumer Loans | 20,258 | 2.8 |

| Other Loans | 6,396 | 0.9 |

| Less: Unearned Income | (1,782) | (0.2) |

| Total Loans | 713,746 | 100.0 |

Source: Report of Condition and Income.

Scope of Evaluation

This evaluation covers the period from the previous evaluation dated September 27, 2018, to the current evaluation dated September 30, 2021. Examiners used Interagency Intermediate Small Institution Examination Procedures to evaluate IFB's CRA performance. As shown in the assessment area breakdown, the Miami-Miami Beach-Kendall, FL MD assessment area comprises a significant majority of the loans reviewed (99.4 percent) and deposits (82.0 percent). Consequently, examiners gave considerably more weight to the bank's overall performance in the State of Florida.

Conclusions on Performance Criteria

LENDING TEST

Overall, IFB demonstrated satisfactory performance under the Lending Test. The bank's net loan-to-deposit (NLTD) ratio is reasonable... averaging 88.5 percent for the previous 12 quarters.

Lending Inside and Outside of the Assessment Areas| Loan Category | Inside | Outside | Total (000s) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| # | % | $(000s) | % | # | % | $(000s) | % | ||

| Home Mortgage | |||||||||

| 2019 | 49 | 94.2 | 53,702 | 96.3 | 3 | 5.8 | 2,048 | 3.7 | 55,750 |

| 2020 | 38 | 63.3 | 36,600 | 54.4 | 22 | 36.7 | 30,618 | 45.6 | 67,218 |

| Small Business | |||||||||

| 2019 | 31 | 68.9 | 11,844 | 61.4 | 14 | 31.1 | 7,439 | 38.5 | 19,283 |

| 2020 | 57 | 90.5 | 7,419 | 94.9 | 6 | 9.5 | 398 | 5.1 | 7,817 |

| Totals | 175 | 79.5 | 109,565 | 73.0 | 45 | 20.5 | 40,503 | 27.0 | 150,068 |

Source: Bank Data.

COMMUNITY DEVELOPMENT TEST

The institution's community development performance demonstrates adequate responsiveness... IFB originated or purchased 38 community development loans totaling $40.2 million.

Community Development Activities Table| Assessment Area | Loans # | Loans $(000s) | Investments # | Investments $(000s) | Services # |

|---|---|---|---|---|---|

| Miami-Miami Beach-Kendall, FL | 18 | 34,655 | 25 | 3,181 | 22 |

| New York-Jersey City, NY-NJ | 19 | 2,645 | 9 | 1,100 | 1 |

| Statewide (FL) | 1 | 2,918 | 2 | 122 | 0 |

| Totals | 38 | 40,218 | 36 | 4,403 | 23 |

Source: Bank Records.

Discriminatory or Other Illegal Credit Practices Review

The bank's compliance with the laws relating to discrimination and other illegal credit practices was reviewed, including the Fair Housing Act and the Equal Credit Opportunity Act. Examiners did not identify any discriminatory or other illegal credit practices.

State of Florida Assessment

CRA RATING FOR FLORIDA: SATISFACTORY.

The assessment area includes all 519 census tracts in Miami-Dade County.

Demographic Info (Florida Assessment Area)| Characteristics | # | Low % | Mod % | Mid % | Upp % |

|---|---|---|---|---|---|

| Census Tracts | 519 | 5.8 | 27.7 | 28.9 | 34.1 |

| Population | 2,639,042 | 5.5 | 29.7 | 30.9 | 33.2 |

| Housing Units | 998,833 | 5.3 | 27.5 | 29.3 | 37.2 |

| Businesses | 533,780 | 3.1 | 20.8 | 25.9 | 47.8 |

Source: 2015 ACS Census and 2020 D&B Data.

Geographic Distribution (Florida): The geographic distribution of home mortgage and small business loans reflects reasonable dispersion throughout the assessment area. In 2019, the bank's home mortgage lending in low-income census tracts was consistent with aggregate data. In 2020, lending was lower but opportunities were limited.

Geographic Distribution of Home Mortgage Loans (Florida)| Tract Income Level | % of Owner-Occupied | Aggregate Performance % | Bank 2019 # | Bank 2019 % | Bank 2020 # | Bank 2020 % |

|---|---|---|---|---|---|---|

| Low | 2.0 | 1.8 | 1 | 2.0 | 0 | 0.0 |

| Moderate | 21.4 | 18.6 | 7 | 14.3 | 6 | 16.2 |

| Middle | 31.9 | 31.9 | 4 | 8.2 | 3 | 8.1 |

| Upper | 44.4 | 47.0 | 35 | 71.4 | 22 | 59.5 |

Borrower Profile (Florida): The distribution of borrowers reflects poor penetration among individuals of different income levels. The bank originated no loans to low- or moderate-income borrowers in 2019 or 2020.

State of New York Assessment

CRA RATING FOR NEW YORK: NEEDS TO IMPROVE.

The Lending Test is rated: Needs to Improve.

The Community Development Test is rated: Satisfactory.

The assessment area includes all 2,057 census tracts in Bronx, Kings, New York, and Queens counties.

Demographic Info (New York Assessment Area)| Characteristics | # | Low % | Mod % | Mid % | Upp % |

|---|---|---|---|---|---|

| Census Tracts | 2,057 | 13.9 | 27.3 | 29.8 | 25.9 |

| Population | 7,954,262 | 17.6 | 30.3 | 26.2 | 25.6 |

| Businesses | 794,884 | 8.9 | 21.3 | 20.5 | 46.4 |

Source: 2015 ACS Census and 2020 D&B Data.

Conclusions (New York): Overall, examiners could not form reasonable conclusions regarding the bank's geographic distribution of loans and distribution of borrowers because of the low volume of home mortgage and small business loans originated in this assessment area. The bank originated no home mortgage loans in 2019 and only one in 2020.

Appendices

Intermediate Small Bank Performance Criteria:

- Lending Test: Evaluates loan-to-deposit ratio, percentage of loans in assessment area, geographic distribution, and borrower profile.

- Community Development Test: Evaluates number and amount of community development loans, qualified investments, and services.

Summary of Ratings

| Rated Area | Lending Test | Community Development Test | Rating |

|---|---|---|---|

| Florida | Satisfactory | Satisfactory | Satisfactory |

| New York | Needs to Improve | Satisfactory | Needs to Improve |

HMDA Notice

The HMDA data about our residential mortgage lending are available online for review. The data show geographic distribution of loans and applications; ethnicity, race, sex, age, and income of applicants and borrowers; and information about loan approvals and denials.

For more information, visit the Consumer Financial Protection Bureau's website (www.consumerfinance.gov/hmda).

Glossary of Terms

Aggregate Lending: The number of loans originated and purchased by all reporting lenders in specified income categories as a percentage of the aggregate number of loans originated and purchased by all reporting lenders in the metropolitan area/assessment area.

American Community Survey (ACS): A nationwide United States Census survey that produces demographic, social, housing, and economic estimates.

Area Median Income: The median family income for the MSA, if a person or geography is located in an MSA.

Assessment Area: A geographic area delineated by the bank under the requirements of the Community Reinvestment Act.

Census Tract: A small, relatively permanent statistical subdivision of a county or equivalent entity... generally have a population size between 1,200 and 8,000 people.

Community Development: Activities that support affordable housing, target community services toward low- and moderate-income individuals, promote economic development by financing small businesses, or revitalize/stabilize low- and moderate-income geographies.

Community Development Financial Institutions (CDFIs): Private intermediaries (either for profit or nonprofit) with community development as their primary mission.

Consumer Loan(s): A loan(s) to one or more individuals for household, family, or other personal expenditures.

Family: Includes a householder and one or more other persons living in the same household who are related to the householder by birth, marriage, or adoption.

Geography: A census tract delineated by the United States Bureau of the Census in the most recent decennial census.

Home Mortgage Disclosure Act (HMDA): The statute that requires certain mortgage lenders... to file annual summary reports of their mortgage lending activity.

Low-Income: Individual income that is less than 50 percent of the area median income.

Market Share: The number of loans originated and purchased by the institution as a percentage of the aggregate number of loans originated and purchased by all reporting lenders in the metropolitan area/assessment area.

Middle-Income: Individual income that is at least 80 percent and less than 120 percent of the area median income.

Moderate-Income: Individual income that is at least 50 percent and less than 80 percent of the area median income.

Small Business Loan: Loans included in “loans to small businesses”... having original amounts of $1 million or less.

Upper-Income: Individual income that is 120 percent or more of the area median income.