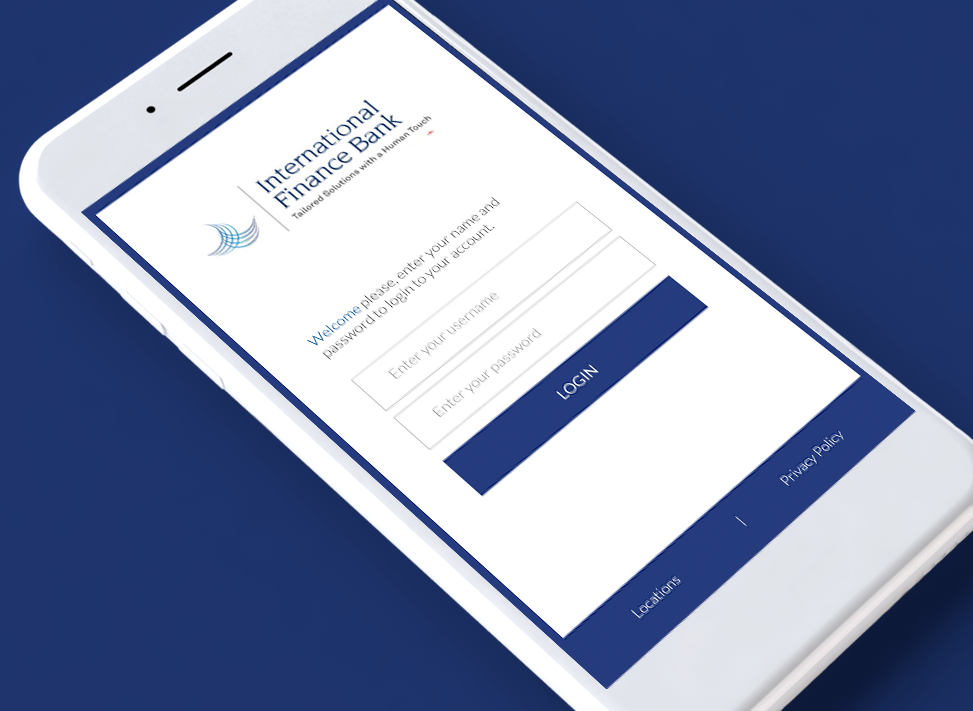

International Finance Bank Mobile Banking—Convenience On the Go

Manage all your accounts right from your device. With our convenient mobile app, you can easily check your balance, deposit checks, transfer funds, pay your bills, and more. Download the app now.